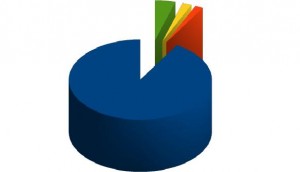

Did you know that at least 91.5% of the return of an investment portfolio is due to its Asset Allocation ? The remaining 8.5% can be attributed to Security selection 4.6%, Market timing 1.8% and Other Factors 2.1%. Surprising isn’t it? That is the reason why we at Harrow Financial place such a high priority on your Asset Allocation.

Since there are several influences that sway the markets, being invested in only one asset category or only one Stock or Bond is not a good idea. It’s like putting all your eggs in one basket.

Asset Allocation is the most sincere admission that no one can predict the markets outcome, so……….you diversify, because when you diversify some of your Asset Categories may be out of favor, but others will be in a favorable position. What we are looking for here is a constant average between the ups and downs.

Further diversification can include “Sectors” such as different industries, like Real Estate,Energy, Healthcare, Technology, etc.

To find out more on how you can diversify and balance your portfolio. Contact Us